Changing Patterns XXIV: Mortgage Lending to Traditionally Underserved Borrowers & Neighborhoods in Boston, Greater Boston and Massachusetts 2016, provides an analysis of area lending patterns. Changing Patterns XXIV was prepared for the Massachusetts Community & Banking Council by Jim Campen, professor emeritus of economics at UMass Boston and longtime MAHA board member.

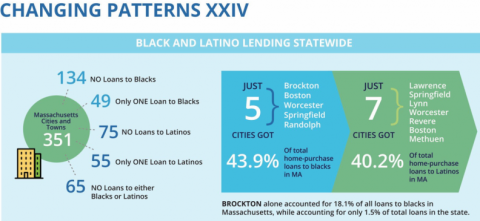

Total home-purchase lending to blacks and Latinos in 2016 was highly concentrated in a small number of the state’s cities and towns, and entirely absent in many others. Brockton alone accounted for 18% of all loans to blacks in Massachusetts, while accounting for only 1.5% of total loans in the state. Just five cities (adding Boston, Worcester, Springfield, and Randolph) accounted for almost one-half (44%) of all loans to blacks in Massachusetts, while accounting for only 12% of the state’s total loans. Seven cities (Lawrence, Springfield, Lynn, Worcester, Revere, Boston, and Methuen) accounted for 40% of all loans to Latinos in the state, while accounting for just 14% of the state's total loans. Meanwhile, in 65 of the state's 351 cities and towns - down from 86 in the previous two years - there was not a single home-purchase loan to either a black or Latino homebuyer.

For the first time in the twenty-four year history of the Changing Patterns series, Massachusetts banks and credit unions did not clearly outperform the other types of lenders as as measured by the percentage of the total loans that went to five traditionally underserved borrowers and neighborhoods. The improved relative performance by licensed mortgage lenders likely reflects the continuing impact of the state's CRA for Mortgage Lenders law. More information about Changing Patterns XXIII can be found on MCBC's website.

Last Year's Report: Changing Patterns XXIII

Previous reports can be found under Archives