51,571

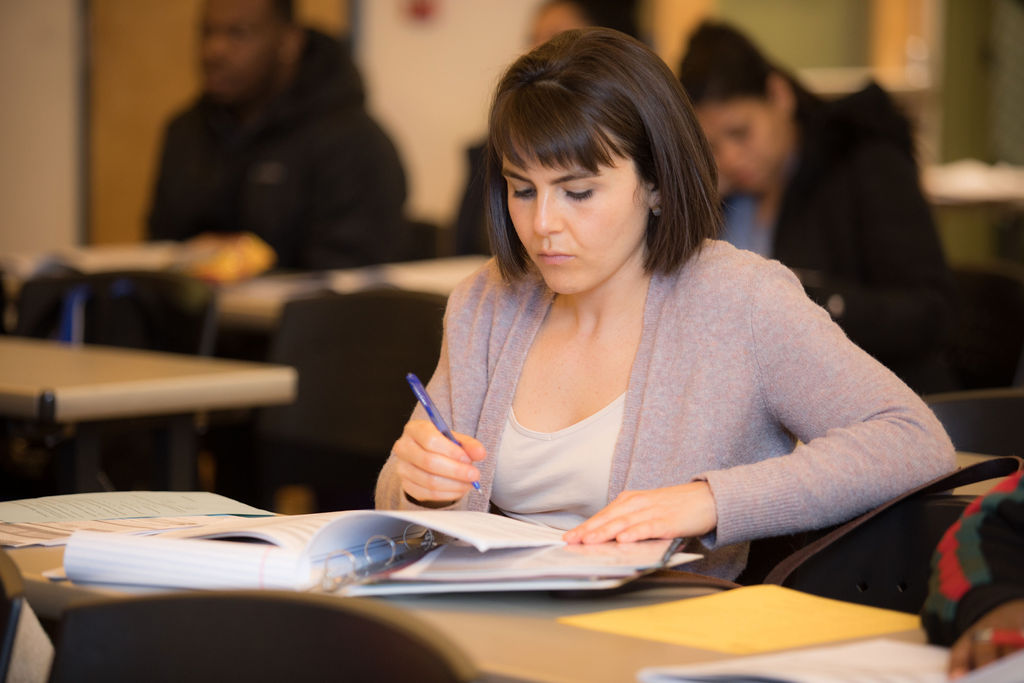

Graduates from homebuyer and

homeowner classes since 1991

759

MAHA graduates bought

their first home in 2024

277

STASH First-Gen Home graduates have

become homeowners since 2019

3,389

People took action with MAHA to advocate for affordable homeownership in 2024

Latest News & Blogs

Stay informed by subscribing to MAHA's blog and the latest news. Get valuable insights, housing program updates, and homebuying tips directly to your inbox. Join our community today and take the first step towards your dream of homeownership.

Subscribe to our Newsletter!

Get valuable insights, housing program updates, and homebuying tips directly to your inbox.

Join our community today and take the first step towards your dream of homeownership.

Join our community today and take the first step towards your dream of homeownership.